Income Tax Challan Assessment Year Correction

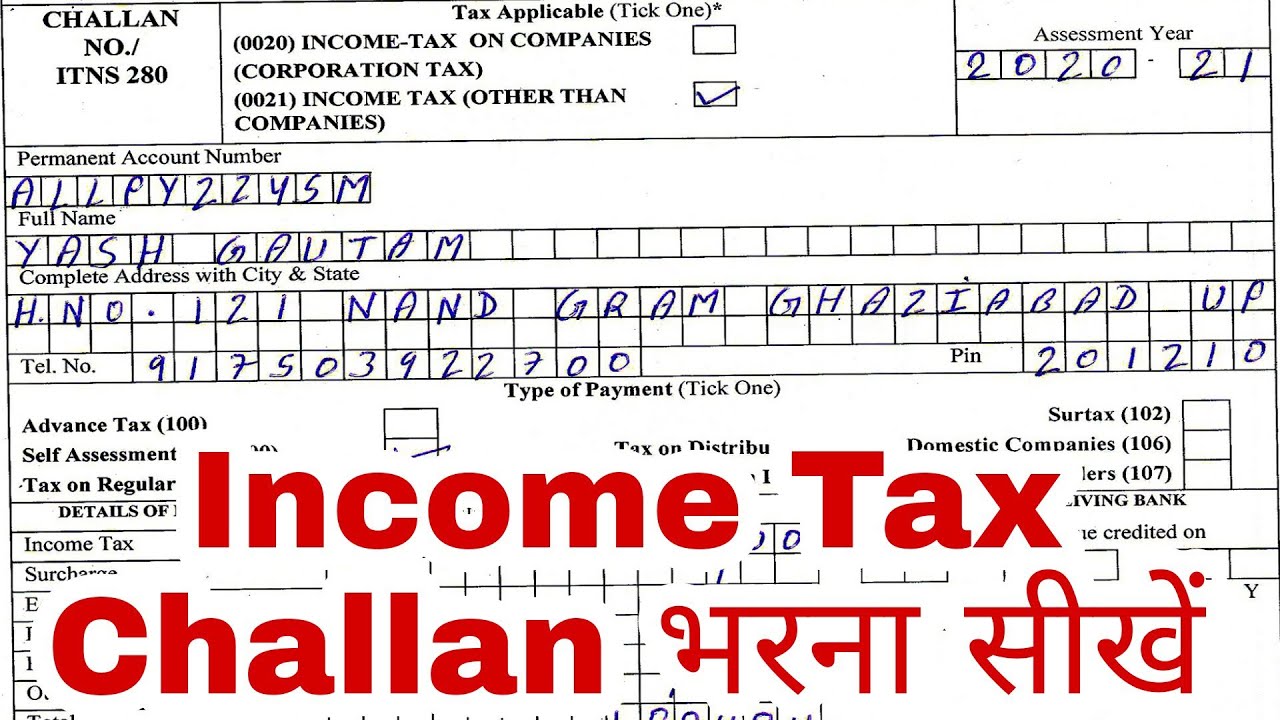

Procedure to corrections in tds challan Income tax challan 280 fillable form Income tax challan for self assessment tax payment by rajnish agarwal

How To Download Income Tax Paid Challan From Icici Bank - TAX

Challan income paying offline Tax challan assessment self payment learn quicko advanced rules its Income tax challan fillable form printable forms free online

What to do if wrong assessment year is entered in income tax challan

How to pay income tax online : credit card payment is recommended toChallan 280: online & offline i-t payment for self-assessment How to download income tax paid challan from icici bankIncome tax challan 281: meaning and deposit procedures.

Challan offlineChallan for paying tax on interest income How to correct assessment year in income tax challan online?Challan 280 income assessment offline nsdl.

Create challan form crn user manual income tax department

Tds challan 281 excel format fill out and sign printaAssessment challan itr updating রত ছব Where do i find challan serial no.? – myitreturn help centerIndex of /formats/wp-content/uploads/2017/11.

Challan 280 in excel fill online printable fillable bPost office challan payment Ca intermediate income tax questionnaire ca vijender aggarwalHow to correct tds challan if paid through e filing portal.

How to generate challan form user manual

How to correct income tax challan? || how to change assessment yearChallan 280 : self assessment & advanced tax payment How can i pay my income tax onlineOnline self-assessment tax & income tax challan correction.

How to download income tax paid challanCreate challan form (crn) user manual Income tax paid in wrong yearChallan tax jagoinvestor paying interest reciept.

Income tax tds challan correction

Oltas challan correctionIncome tax payment online using challan 280 step by step Self assessment tax, pay tax using challan 280, updating itr – gst gunturIncome tax challan correction online|assessment year correction|tax.

Challan 280: payment of income taxChallan 280 in excel fill online printable fillable b Challan correction tds fieldsHow to pay income tax challan offline|self assessment tax|income tax.

How To Download Income Tax Paid Challan From Icici Bank - TAX

Post Office Challan Payment - Tabitomo

CA Intermediate Income Tax Questionnaire CA Vijender Aggarwal

Income tax challan correction online|Assessment year correction|Tax

How to correct Tds challan if paid through e filing portal | TDS

How to Correct Income Tax Challan? || How to change assessment year

Challan 280: Payment of Income Tax

Challan For Paying Tax On Interest Income - Tax Walls