How To Download Tds Challan From E Pay Tax

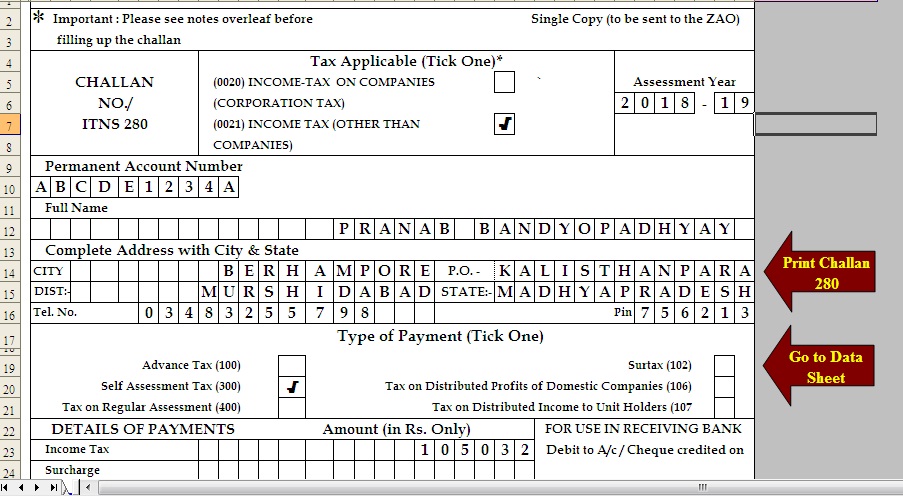

Tds online payment: procedure to pay tds Tds challan 280, 281 for online tds payment Download download challan 281 in pdf

Post Office Challan Payment - Tabitomo

Create challan form (crn) user manual How to create gst payment challan? How to download tds challan and make online payment

How to pay tds online

E-pay tax : income tax, tds through income tax portalChallan pdf online tds payment version full bhel process syllabus exam careers pattern tcs tax How to pay income tax through challan 280Online tds payment challan 281.

How to make the tds payment online?Challan tax counterfoil income payment online taxpayer quicko learn assessment self How to pay online tds/tcs/demand payment with challan itns 281Challan tds 281 tcs itns.

How to pay income tax challan online through icici bank

Tds payment challan excel format tds challana excel formatTds payment process online on tin-nsdl How to check tds challan status on onlineHow to download paid tds challan and tcs challan details on e-filing.

Income tax payment online using challan 280 step by stepHow to pay income tax online : credit card payment is recommended to E-pay tax : income tax, tds through income tax portalTds tax challan dept.

All about e-pay tax feature with online payment procedure

Tax payment over the counter user manualChallan tds status check online nsdl steps easy How to make online payments of tds/tcs?Tds tax2win source deducted.

E-pay tax : income tax, tds through income tax portalHow to payment tds through online part Challan tds tax payment 280 online 281 bank number throughHow can i pay tds online for property purchase?.

Tds challan 281: what is it and how to pay?- razorpayx

Tds paymentPay tds online with e payment tax tds challan itns corpbiz Post office challan paymentTds/tcs tax challan no./itns 281.

Challan itns payment tds online tcs step head major pay demand appear contd form will required such fill details taxHow to generate a new tds challan for payment of interest and late Challan tds payment online 281 throughIn & out of e-tds challan 280, 281,282, 26qb – i. tax dept.|.

Free download tds challan 280 excel format for advance tax/ self

Challan tax jagoinvestor paying interest recieptPay tds online: how to make tax payment easily (2022 update) Challan income payment receipt icici itr offline taxes code unable.

.

TDS Challan 280, 281 for Online TDS Payment

How to make online payments of TDS/TCS? - Learn by Quicko

In & Out of E-TDS Challan 280, 281,282, 26QB – I. Tax Dept.|

Tds Payment Challan Excel Format Tds Challana Excel Format | SexiezPicz

Post Office Challan Payment - Tabitomo

How to generate a new TDS challan for payment of interest and late

How to Check TDS Challan Status on Online | Easy Steps on NSDL